Bariatric Surgery - Insurance Coverage

If you are considering bariatric surgery and have health insurance, you will want to review your policy and find out if your insurance plan covers bariatric surgery. Many insurance companies cover the cost of bariatric surgery, but some health plans have an outright exclusion.

When insurers cover bariatric surgery,

it often has a number of requirements.

It is important to contact the insurance company as soon as possible to find out if bariatric surgery is a covered benefit on your specific plan. Insurance coverage for bariatric surgery varies among insurers and health plans, as well as the requirements for coverage, including patient criteria, medical necessity, and previous weight loss history. Some insurers have requirements on documented weight loss attempts under the care of a doctor, age restrictions, weight restrictions, or requirements on what medical provider you use for treatment.

Insurance Coverage for Bariatric Surgery

Even in cases when your health insurance covers bariatric surgery, be aware that coverage is not automatic. Most insurance companies have certain requirements that must be met before pre-approval authorization is given. When reviewing your request, they will consider the procedure and the medical reason for having the procedure. The process may be quick and straight forward for some, but for others that process may be long and frustrating.

Factors that insurance companies consider when determining coverage approval typically include:

- Procedure - Is it a covered benefit?

- Patient Criteria - What is your health status?

- Medical Necessity - Does your diagnosis justify the requested treatment?

- Weight Loss Attempts - Do you have documentation of attempted weight loss?

If your bariatric surgery is covered, take into account that you will still be responsible for any co-pay, deductible, and co-insurance amounts per your policy limits.

Insurance and Choosing A Bariatric Surgeon

Even if your insurance covers bariatric surgery, it is important to choose a surgeon that is covered under your health plan. It is common for health plans to have a list of preferred providers that have agreed to accept the terms of coverage. Check the list provided by your health plan and choose a bariatric surgeon that accepts your health insurance.

Meeting Patient Criteria for Insurance Coverage

An insurance company will look to see whether or not the individual meets the criteria for bariatric surgery based on age, weight, body mass index (BMI), and obesity related health conditions. Many insurance companies will use the patient guidelines for bariatric surgery set by the National Institute of Health (NIH), which include:

- BMI is greater than 40 (morbidly obese), or BMI is greater than 35 (obese) with co-morbidities such as heart disease, diabetes, high blood pressure, sleep apnea, or degenerative arthritis

- Five year history of obesity

- Failure to lose weight with non-surgical methods

- High risk for obesity-associated morbidity or mortality

- Acceptable operative risk

- Willingness to comply with lifetime dietary requirements

Medical Necessity

Most insurance companies require a Letter of Medical Necessity from your bariatric surgeon stating why weight loss surgery is necessary. The letter will usually include information about your weight, BMI, obesity history, health history, weight loss history and the doctor's conclusion that bariatric surgery is medically necessary.

Weight Loss Attempts

Bariatric surgery is an expensive and serious operation and insurance approval will usually be considered only if a patient has made serious attempts to lose weight without surgery. Insurance companies will commonly request documentation of previous weight loss attempts to verify that all other options have been exhausted.

Requested documentation of previous weight loss attempts include items such as:

- Medically supervised weight loss programs

- Enrollment in weight loss centers (Weight Watchers, Jenny Craig, NutriSystem)

- Diet plans (Atkins, Zone, South Beach)

Some insurance companies will request a six month weight loss history, while other insurance companies will require a one to two year history. Some insurance companies may also specifically require participation in a medical weight loss program under doctor supervision.

Covered Bariatric Procedures

Insurance coverage for bariatric surgery can vary based on the specific bariatric procedure. Gastric bypass surgery is the most commonly covered bariatric procedure because it has been performed for so many years and has been shown to be a very effective treatment for obesity as well as many metabolic conditions. Gastric band surgery and sleeve gastrectomy were once considered experimental and investigational procedures, but are now considered an accepted bariatric procedure and are covered by many insurance companies, including Medicare. Duodenal switch is still not covered by many insurance companies.

Handling Insurance Denials

Many insurancedenials for

bariatric surgery

can be reversed

during the

appeals process.

If you submit an insurance request for bariatric surgery and receive a denial, it may still be possible to get approval through the appeals process. When you get a denial, contact the insurance company to find out the specific reasons why coverage was not approved. Often, the first denial is due to issues which can be worked out, such as lack of weight loss documentation or appropriate medical information.

Many bariatric patients have been successful in gaining coverage for bariatric surgery by appealing the denial and then working to satisfy the insurance requirements. While it is important to be personally involved and persistent with the insurance company, it is also helpful to have your doctor assist you in getting insurance approval.

Related Articles

Social

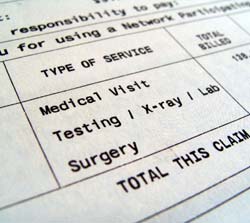

Understanding Insurance Codes

The insurance company relies on numerical codes when reviewing your request for coverage. When claims or pre-approval requests are submitted, the CPT code indicates the procedure (type of surgery) and the ICD-9 code indicates the diagnosis (reason for treatment, i.e. severe obesity or diabetes).